New Historical Revenue Smoothing Accomplished by MOA and Others

![]() New Historical Revenue Smoothing Accomplished by MOA and Others

New Historical Revenue Smoothing Accomplished by MOA and Others

- By Jeff Schahczenski, Agricultural and Natural Resource Economist, NCAT

On June 5, 2019, the Federal Crop Insurance Corporation (FCIC), which oversees the entire federal crop insurance program, announced important changes to the Whole Farm Revenue Protection (WFRP) policy as a result of legislation passed in the 2018 Farm Bill. MOA, the National Sustainable Agriculture Coalition, the National Center for Appropriate Technology (NCAT) and many others succeeded after many years of effort to improve WFRP is a significant way. Essentially, the changes explained below will significantly improve coverage for those using this policy to protect organic and those with diverse cropping and livestock systems. WFRP is the first nationwide policy that provides significant premium discounts for those who grow more than three crop or livestock products. It is the first and only federally-subsidized insurance product that protects whole-farm revenue and NOT a specific crop or livestock product. It is a product ideal for organic and sustainable farming.

The critical change made has been to “smooth” the impact of historic high-levels of revenue variability that many farmers experience (and maybe more so if climate disruption continues). These changes are modeled after the same “adjustments” that are made to a farmer’s “actual production history” (APH) in single crop revenue policies, the difference is that the adjustments are made to historic revenue rather than yield. Here is an example of the impact of this important improvement.

Example: Montana Organic Grain Farm

This example is based on a hypothetical 3,000-acre organic grain farm in Hill, County Montana and the year of insurance is 2018. Thought hypothetical the estimates are roughly based on a realistic expectation of what an organic grain farmer’s revenue history could be. Table 1 is the organic grain farmers’ five years’ adjusted gross revenue history experience.

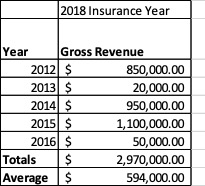

Table 1. Organic Farm Historic Adjusted Gross Revenue: Hill County, MT

The expected gross revenue for the insurance year is 1 million dollars. Under current policy rules, the premium would be based on the $594,000 average, and at an 85% coverage level, the farmer could cover up to $504,900 of revenue in the insurance year. What this means that the farmer would not receive any insurance indemnity if losses were not greater than $504,900. This is called the “trigger” point. Given the historic variability of the revenue of this farm, the “average” does not come very close to covering the realistic expectation of the farmer to obtain 1 million dollars in gross revenue in 2019. One could say the farmer is “under-insured” in this case or a least it is a high deductible policy.

There are three expected changes to how the average historic adjusted gross income will be determined. These are:

Each year that the historic revenue is below 60% of producers’ average historic revenue will be replaced with the average revenue.

The lowest historic revenue year will be dropped and the average will be based on the remaining four years of adjusted gross income

The approved revenue for the insurance year will be at least 90% of the adjusted gross income.

So the adjustments to this example would be:

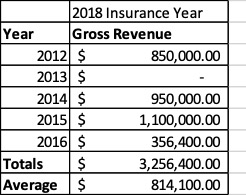

- 60% of 594,000 is $356,400 and therefore this replaces the values in 2013 and 2016.

- The lowest value is 2013 and is dropped. The approved revenue for the insurance year is 1 million dollars, 90% of that is $900,000.

Table 2. Organic Farm Historic Adjusted Gross Revenue with new policy: Hill County, MT

These changes will make WFRP a better product over the longer-term given the often high degree of variability of a farmer’s income. Also, the extra incentive for premium discounts as crop and livestock diversity makes this an ideal policy to support truly sustainable agriculture. Thanks to MOA and so many others over many years of hard work to make this happen.